What Is the Current Ratio?

The modern-day ratio is a liquidity ratio that measures a agency’s ability to pay quick-time period responsibilities or the ones due inside three hundred and sixty five days. It tells investors and analysts how a employer can maximize the current assets on its balance sheet to meet its modern-day debt and other payables.

A current ratio this is in step with the enterprise average or barely higher is commonly taken into consideration applicable. A modern ratio that is decrease than the industry average can also imply a higher danger of distress or default. Similarly, if a organization has a completely high current ratio as compared with its peer group, it indicates that management may not be the usage of its property successfully.

The present day ratio is known as present day due to the fact, in contrast to a few other liquidity ratios, it incorporates all current belongings and modern liabilities. The modern-day ratio is every so often referred to as the running capital ratio.

Main Point:

- The current ratio is a comparison of all a company’s assets and liabilities.

- Assets that are in cash or that will become cash within a year are typically defined, as are liabilities that will pay out in less than a year.

- The current ratio allows investors to compare apples-to-apples with their competitors and peers and understand a company’s ability cover its short-term liabilities with current assets.

- The current ratio has a weakness in that it is difficult to compare across industries.

- Other problems include overgeneralizing the specific balances of assets and liabilities, and the absence of trending data.

Current Ratio Definition

This ratio is sometimes called the working capital or current ratio. This ratio compares the current assets and liabilities of a company. You can also find out more about our products and services. To test if the company’s current liabilities are sustainable, it is compared to its assets, funding, and liabilities. The current ratio is often used to measure a company’s financial health because it shows its ability to repay short-term debts.

In the current ratio, assets and liabilities are often grouped by a specific time period. liabilities are due in one year. In this formula, current assets are the resources that the company will consume or liquidate (convert to cash) in one year.

Who Uses this Ratio?

The current ratio can be used by business owners or the financial team to gauge the health of their company. This ratio is also used by accountants, since accounting is closely related to reporting assets and liabilities in financial statements.

Investors and lenders outside of the company may use a current ratio to decide if they wish to work with that company. This ratio can be useful to lenders, as it indicates whether a company is able to pay off current debts and not add more loans.

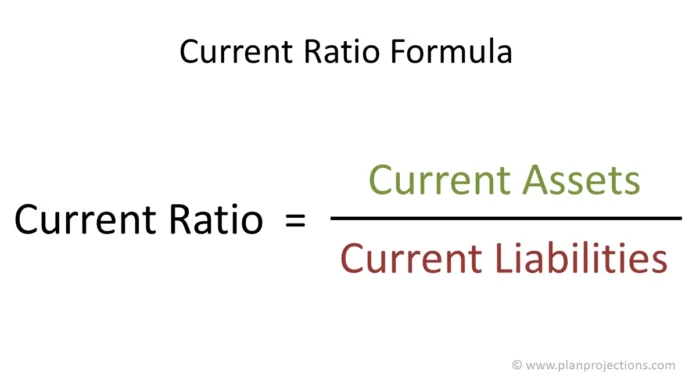

Current Ratio Formula

The formula to calculate the current ratio is:

Current Ratio = Current Assets / Current Liabilities

Components of the Formula

Current Assets

Current assets are the resources of a business that can be liquidated within a year. Current assets can include:

- Cash equivalents:Paper money, coins, or currency as well as the balance in checking and savings accounts

- Marketable Securities: Financial instruments that can be purchased or sold on the public exchanges such as stocks, bonds and shares

- Accounts Receivable:Money that is owed by customers and clients to a business

- Inventory:Products sold by a business and materials used in their production

- Other Current Assets: Assets that are too insignificant or rare to merit a separate category. This includes selling real estate or equipment.

A similar ratio, called the quick ratio compares the liquid assets of a company to its current liabilities. The quick ratio does not include prepaid expenses or inventory in the assets category, as they cannot be liquidated as easily as cash and stocks.

Current Liabilities

Current liabilities are the debts that the company has to repay in the next year. Liabilities include:

- Accounts Payable:Money that a company is owed by clients, creditors and customers

- A loan or other financing form with fixed interest rates

- Deferred Revenue: Money received by the company from its customers before it delivers goods or services.

- Other current liability: Inconsequential fees or unusual fees that are not significant enough to warrant a separate section on the balance sheet. This includes miscellaneous charges, unpaid property taxes or costs associated with franchising operations.

Example of How to Calculate the Current Ratio

A balance sheet lists all the information had to calculate the current ratio. The stability sheet is usually a part of any huge fiscal file, inclusive of a quarterly or annual income file. Using Apple’s income record for the fiscal year 2022, we will locate the following details at the stability sheet:

Apple’s Reported Current Assets

| Cash and cash equivalents | $23,646 million |

| Marketable securities | $24,658 million |

| Accounts receivable | $28,184 million |

| Inventories | $4,946 million |

| Other current assets | $53,971 million |

| Total current assets | $135,405 million |

Apple’s Reported Current Liabilities

| Accounts payable | $64,115 million |

| Term debt | $11,128 million |

| Deferred revenue | $7,912 million |

| Other current liabilities | $70,827 million |

| Total current liabilities | $153,982 million |

With this facts, we have the subsequent system:

Current Ratio = $135,405m (current assets) / $153,982m (current liabilities)

So, Apple’s current ratio for 2022 turned into: 0.88

Current ratios can be written in decimals or as X:X kind ratios. So, for Apple, we may also say it has a contemporary ratio of 88:a hundred (or a simplified ratio of twenty-two:25).

However, displaying present day ratios as an actual ratio in preference to a decimal can be greater perplexing and doesn’t always convey the important records as successfully as a decimal. For instance, even as 117:one hundred could be a commonly right current ratio, 1.17 may be simpler to recognize.

What Is a Good Current Ratio?

The current ratio is a measure of the relationship between assets and liabilities. A higher ratio indicates that the company has more liabilities than assets. A current ratio of 4, for example, means that the company can technically pay its current liabilities four-fold. What makes a good ratio depends on your industry. In general, a ratio of 1 to 3 is considered ideal. However, certain industries and business models can function perfectly well with lower ratios.

Many reasons exist for a company having a low current ratio. The inventory on the balance sheet, for example, shows the initial cost of the inventory. The overall ratio can be affected by the fact that companies sell their inventory at a higher price than they paid to acquire it. A company’s inventory may be low due to a loyal customer base and an efficient supply network. The current inventory will then show a lower value and could potentially offset the ratio.

High ratios may not always be a good thing. A high ratio may indicate that a company isn’t maximizing its assets. Companies could, for example, invest the money or use it to promote longer-term growth by using it for research and developments, instead of holding large amounts of liquid assets.

Limitations of Using the Current Ratio

When comparing different companies, the current ratio has a limitation.Comparing the current ratios across industries can be a waste of time. In one industry it might be more common to extend a credit for clients to last 90 days or more, while in another, the importance of short-term collection is more important. Ironically, an industry that extends credit more often may actually have a higher current ratio than another because their current assets are higher. Comparing companies in the same industry is more useful.

The lack of specificity is another drawback to using the current rate, which was briefly discussed above. It includes all current assets of the company, including those that are difficult to liquidate. Imagine two companies with a current rate of 0.80 each at the end of their last quarterly. This may appear to be the same, but it is not. The following breakdown shows how the assets are different.

Current Ratio vs. Quick Ratio

Current ratios and quick ratios are used to measure the financial health of a business by comparing liquid assets with current liabilities. There are some key differences between the two ratios.

The quick ratio first excludes inventory from liquid assets. This is because inventory and pre-paid expenses aren’t very liquid. Inventory takes time to sell and prepaid expenses cannot be used immediately to pay debts.

The evaluation of each ratio is also different. It is possible to use the current ratio when judging companies that have a large inventory of back stock, as it will increase their score. The quick ratio, on the other hand will give lower results to companies who rely heavily upon inventory because it is not included in the calculations. Quick ratios are often conservative in general.

There is no single ratio that can be used to measure the health of a business. To get an accurate picture of the company’s health, it’s best to combine several metrics such as quick and current ratios and profit margins with historical trends.

Showing Current Ratio Skills on a Resume

Prior work or internship experience comparing a enterprise’s financial fitness will usually imply a operating knowledge of the modern-day ratio. However, you can consist of a few information in the description of that experience. For instance, you may say some thing like:

- “Analyzed and quantified the enterprise’s financial health using key metrics, which include the short ratio, contemporary ratio, and profit margins.”

You also can use the abilties phase of your resume to explain specific calculations you recognize, together with the cutting-edge ratio, or consist of it as part of a wider skillset. For instance, to your abilties phase, you could consist of:

- “In-depth expertise of crucial enterprise overall performance metrics, which include sales, income margins, and current ratios.”

However, if you found out this ability via different way, together with coursework or in your own, your cowl letter is a superb region to go into extra detail. For example, you could describe a assignment you probably did at college that concerned comparing a agency’s financial health or an example in which you helped a chum’s small enterprise work out its budget.

FAQs about Current Ratio:

What Is a Good Current Ratio?

What counts as an excellent present day ratio will rely on the organization’s industry and ancient overall performance. Current ratios of one.50 or extra could typically suggest enough liquidity.

What Happens If the Current Ratio Is Less Than 1?

As a general rule, a current ratio below 1.00 could indicate that a company might struggle to meet its short-term obligations, whereas ratios of above 1.00 might indicate a company is able to pay its current debts as they come due. If a company’s current ratio is less than one, it may have more bills to pay than easily accessible resources to pay those bills.

What Does a Current Ratio of 1.5 Mean?

A current ratio of 1.5 would indicate that the company has $1.50 of current assets for every $1 of current liabilities. For example, suppose a company’s current assets consist of $50,000 in cash plus $100,000 in accounts receivable. Its current liabilities, meanwhile, consist of $100,000 in accounts payable. In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current assets ($150,000) by its current liabilities ($100,000).

How to Calculat Current Ratio ?

Calculating the contemporary ratio could be very truthful: Simply divide the organisation’s modern property by way of its modern liabilities. Current property are those who can be transformed into cash inside one year, at the same time as contemporary liabilities are responsibilities expected to be paid within 365 days. Examples of modern-day assets include cash, inventory, and bills receivable. Examples of current liabilities encompass debts payable, wages payable, and the contemporary portion of any scheduled hobby or primary bills.

For More Information visit Our Homepage: