What Is a Bear Trap?

A bear trap is an example of a technical pattern. It occurs when the price movement of a stock or index, or other financial instrument, signals incorrectly a change from an upward trend to a downward trend. The price may rise in a broad upward trend, but then encounter significant resistance or change. Bears will then open short positions in order to take advantage of a falling price indication.

A bear is a financial market investor or trader who believes the price of an asset is about to fall. Bears can also think that the direction of a market is going to decline. A bearish strategy is one that aims to profit from a decline in an asset’s price. Short positions are often used to implement the strategy.

A long position is a trading strategy that involves borrowing shares or contracts from a brokerage via a account of margin. The investor will sell the borrowed instruments and then repurchase them at a lower price, in the hope of profiting from the drop. A bearish investor who incorrectly predicts the price drop increases the risk of being caught in a trap.

Main Point

- A bear trap is an unreliable technical indicator of a market reversal, from a trending up to one in a trending down. It can be used by unsuspecting sellers.

- Bear traps can happen in any asset market, such as equities and futures markets, bonds and currencies.

- A bear trap can be a market correction to the downside in an otherwise bullish upward trend.

- It’s difficult – if not impossible – to predict if a downward correction will continue, or if it will turn into a “bear trap”. From a trading perspective traders should be careful about the size of their positions in case an overall uptrend returns.

How does a bear trap work?

Bear traps can happen in any financial instrument, including stocks, indices and commodities.

After a strong upswing, it appears that the price has hit a resistance and is now starting to fall. The bearish traders then open short positions in order to take advantage of a possible further decline.

If the decline is temporary, then the price will start to rise again. Traders are trapped, and they usually try to cover their short position.

A bear trap is often triggered after a security has experienced a long-term upward trend and the price seems to have stalled at a technical support level. When comparing fundamental analyses, the asset is likely overvalued.

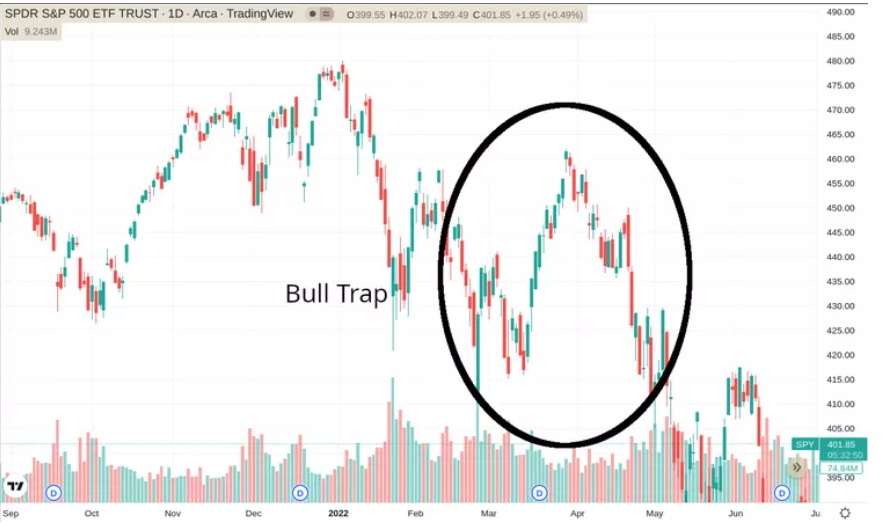

A Bull trap is the opposite of a Bear Trap. Traders buy an asset believing that the downtrend has ended because it is starting to rise. The downtrend then resumes, and the holders of the asset are left ‘long-and-wrong’ when the price continues to decline.

Bear Trap vs. Bull Trap

You should be on the lookout for two different types of traps: bulltraps and beartraps. The overall market trends and conditions will determine which one occurs.

Bear Trap

A bear traps is when a downward correction or reversal occurs within an upward trend. In a downward correction, shorting temporarily overcomes buying pressure and leads to a temporary price drop. The price fall may be large or small, and could fail at recent highs of the uptrend.

It is possible that the downward correction will last for several trading sessions. This can give the false impression that there has been a market reversal. The market will not support further price drops if buyers start to buy more stock as prices fall. The market then quickly resumes its upward trend.

Short traders are in a losing position because they sold the stock at one price, intending to buy it later at a cheaper price. However, after selling at that price and re-purchasing at a lower cost price at a future date, the price rose. They are trapped in a losing situation, as they have to repurchase the stock at a higher cost.

Bull Trap

Bull traps occur when a general downward trend is followed by a short-term upward or bullish price trend. This short-lived upward trend can be used to trick traders into taking positions that could lead to losses. In a “bull trap”, traders may take long positions when the market falsely indicates that a reverse is taking place. In a bull trap, traders may take long positions because the market is falsely indicating that a reversal is underway.

Causes of a Bear Trap

Investors and traders will notice that the price trend has reversed. Stock prices can drop for many reasons: government reports, geopolitical issues, press releases from companies, rumors about a recession or any other reason that could create fear and doubt. Investors begin to sell, which causes prices to fall.

If traders believe that the trend is changing, they will take short positions. The price drops as more traders sell and short until it reaches a level of support that triggers a rebound. The market determines the support level. The market determines the support level.

Identifying a Bear Trap

As prices increase, short sellers must cover their positions to minimize their losses. Short-sellers are forced to buy instruments to cover their positions, and when buyers begin to purchase the asset, the downward momentum tends to diminish. An increase in purchasing activity can lead to further price growth.

Even for technical traders, the fundamentals are crucial in identifying a “bear trap”. A bear trap is a false indicator, so the only thing that changes is the stock price. If, for example, none of the fundamentals have changed in your favor (e.g. economic data and financial data from companies), you should not expect anything more than a Bear Trap Correction.

There’s no reason why the downward trend that you’re trying to short should not continue if the fundamentals are different. You can short at better prices if the trend is downwards and you see a Bear Trap Correction. If you are wrong, you will still have to place a stop above. If the trend is in your favor, then a beartrap may be a sign to short a correction with the expectation that the uptrend will resume. You’ll still need to place a stop order above if you are wrong.

How to Avoid a Bear Trap

You can check if the decline is a trap by looking at some of these signs:

- Observe trading volume: Look at the instrument’s trading volume. If the volume is low, this may indicate that it’s a temporary change in price.

- Use trading tools Put options and stop-orders can help minimize your losses if a short downtrend is only temporary.

- Technical Analysis: Fibonacci Retracements and relative strength index can help you predict and understand whether the current trend in a security’s price is sustainable and legitimate.

- Candlestick Indicators: Candlestick patterns like Evening Star, Bearish Engulfing, and 3 Black Crows will help you to identify a beartrap.

Real-World Example

Many stocks exhibit bear traps during market uptrends. In the image of the reverse bear trap above, ConocoPhillips stock was on an upward trend for several months prior to its fall. It fell rapidly at the beginning of October 2022. After trading at support levels for a couple days, it rebounded and rose to its previous level.

If traders who had taken short positions during the 9-day period when the stock was falling were not able to place stop orders, or take other actions to avoid being caught in the trap.

FAQs About Bear Trap

How Do You Trade a Bear Trap?

You can use a short, but make sure you put in a stop-order just in case. You could enter a long trade during a downtrend if the fundamentals are still good.

Is a Bear Trap Bullish?

A bear trap can be short-term negative but long-term positive because it occurs most often in a bullish trend.

What Is Bull Trap vs. Bear Trap?

A bull trap is opposite to a beartrap, in which traders may assume that a downward trend will reverse and start to take long positions only to see the market continue its downward trend.

For More Information visit our Homepage: