You may have an investment goal in REITs(Real estate investment trust), but you do not fully understand the process. Look no further. Money 6x REIT Holdings will take you through every aspect of REIT holdings.

Our guide covers a wide range of topics, from the definition of REITs to the analytical tools needed to make good investment decisions.

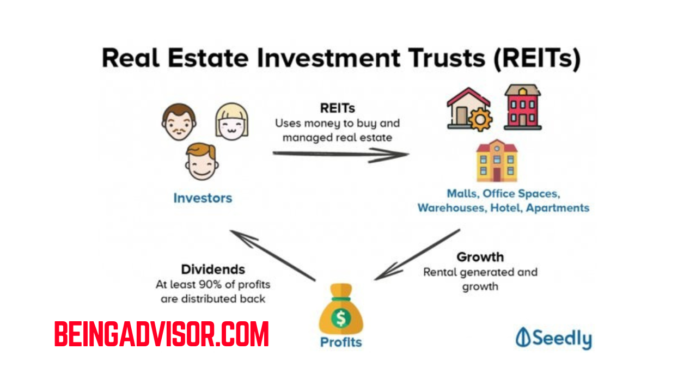

It can be intimidating to invest in property, especially if you don’t have enough time or capital to go through the tedious process of buying directly. This is where REITs come in. They replace actual assets with real estate. REITs offer investors the opportunity to invest in the real estate industry without having to deal with the hassles of property management.

We will explore REITs in the following pages to learn more about them and their workings, as well as the different types of REITs, their benefits and risks. We will also go deeper into the understanding of REITs. For example, we will learn how to appraise the quality and diversity of a REIT’s Portfolio.

This guide will help you prepare for REIT shares, regardless of whether you’ve had experience with financial real estate investments or are just getting started. Let’s begin!

Understanding money 6x REIT Holdings

Real Estate Investment Trust is the name of the company that manages all REIT properties. The spectrum of REITs can be wide, and they may include a variety of assets, such as residential, commercial and industrial properties, and even healthcare facilities. REITs invest in properties that generate income through rents, and then sell them for a profit.

To understand the REIT investment, you need to know the assets that the company owns. They own different types of properties, in different areas. Also, their taste and diversity are different. Investors will be able make an informed decision about REITs and whether they should invest and if the returns and risks are favorable.

Types of Properties in REIT Holdings

Real Estate Investment Trusts offer a wide range of possibilities, including properties with different characteristics and potential profits. Money 6x REIT holdings includes a variety of different types of property.

- Residential Property: This type of housing can include apartment buildings, condos or single-family homes. Rental incomes may be stable from residential properties.

- Commercial Property: This category includes commercial properties such as shopping centers and offices. Commercial properties can offer higher rental incomes than residential properties. However, they fluctuate in accordance with the economic cycle.

- Warehouses, distribution centers, and manufacturing facilities are all examples of industrial properties. Industrial buildings can be a stable source of income, particularly for those units that are located near active distribution and shipping facilities.

- Healthcare Property: This could be a facility such as a hospital, medical office, or senior living home. The ability of healthcare properties to generate a consistent income and increase in demand over time can help stabilize a portfolio.

There are also REITs which focus on a specific type of property, while others have a mix of properties. The choice of property is based on each investor’s attitude to risk and desired goals.

Benefits of Investing in REITs

Money 6x REIT Holdings explains that REITs offer investors several advantages, including:

- Diversification – REITs provide a way to diversify your investment portfolio beyond traditional stocks and bonds. Diverse property types and geographic areas can be used to diversify risks and strengthen gains.

- Professional Management: Many of the REITs have seasoned professionals who handle asset acquisition, disposition, and leasing. The investors do not have to deal with the hassles of real estate ownership. They can earn passive income by owning real estate.

- Liquidity: Unlike direct real estate investment, REITs allow investors to quickly get rid of their shares by trading them in the same trading market. REIT investors are able to buy and sell REITs easily, giving them the advantage of being flexible and gaining access to their money whenever they need it.

- REITs are required to pay capital investors a large portion of their taxable income in earnings. This gives them an advantage among investors who are looking for income, regardless of interest rate levels.

- Potential Capital Appreciation. REITs can also provide capital appreciation in addition to dividends. REITs can increase in value over time by valuing their holdings. This could be a way for investors to gain capital.

Factors to Consider When Evaluating REIT Holdings

The way a REIT’s portfolio is divided and analyzed depends on several factors. Consider these key factors, based on Money 6x REIT Holdings:

- Property Location: You will see the greatest impact on the return of properties based on the geographical area where properties are located. Premium properties located in areas with robust economic growth and strong fundamentals will likely perform well, while those with sustained economic weaknesses will underperform.

- Property Quality: As the first thing to consider, the property’s quality is also important. Renting income is more likely to be generated by properties with modern, updated, and inviting amenities and infrastructures.

- Tenant base: It is important to carefully examine the tenant mix because it will determine how stable your rental income will be. A tenancy portfolio with a mix of long-term contracts will minimize the risk of income instability caused by vacancies or other issues.

- Occupancy rates: The occupancy rate of properties managed by a REIT and its attractiveness to tenants are indicators that the demand for the properties has changed, and that the REIT is able to retain and attract new tenants. The more rental properties that are occupied, the higher the income.

- Lease terms: A close examination of the lease can provide insight into the predictability of income and stability of price. Rent increases and fixed leases will result in a long-term risk of income reductions due to constant income source visibility.

Analyzing REIT Holdings Performance

REIT Investments are evaluated based on their financial performance and numbers. Money 6x REIT holdings should be evaluated using the following key metrics:

- FFO (Funds from Operations): FFO is the acronym for the Cash Flow that represents the core business. It excludes items that are not monetary, such as depreciation, gains/losses from the sale of property, and other non-monetary items.

- Net Operating Income (NOI). It’s also important to note that NOI is a measure of the income generated by a property, after certain expenses for operating have been subtracted. It is a good indicator of the profitability and effectiveness of the REIT property.

- Dividend Yield is the amount of dividends paid per share in a year. It reveals the amount of income or earnings compared to the actual share price, and can be used as a factor in assessing the impact of an investment.

- Total Yield: A total return would mean that both dividend income as well as capital appreciation are included in the REIT’s performance. It helps to get a good idea of the overall profitability of an investment.

These metrics, whether they are calculated daily or monthly, will help investors understand the underlying trends and compare REITs to make informed decisions about their investment strategy.

Risks Associated with REIT Holdings

Investment in REITs can open many doors, but also cause some concern. Investing in REITs can come with a number of risks.

- Market Risk: REITs are affected, like the rest, by market conditions and the economic performance of the nation. Interest rates and economic downturns, as well as real estate price fluctuations, can affect REIT performance and return on their holdings.

- Property Risk: The value of a REIT’s properties may be affected by factors such as lease demand, location and any changes in the market which alter the dynamics of supply and demand. Dropping property values can have a negative impact on REIT performance.

- Liquidity risk: REIT shares can be traded on the stock exchange. However, there are periods of illiquidity which make it difficult to sell shares at the right price and to purchase shares at the desired price. Illiquid markets can also make it difficult to obtain capital if you need a large capital expenditure.

- Regulatory Risk An REIT faces the constant changes in tax codes and regulations. Modifications to regulations can reduce profitability and change the tax efficiency investors receive.

- Interest Rate Risk: REITs rates may be affected by changes in interest rates. Increased interest rates can increase the borrowing costs for REITs, which could negatively affect their profits and share prices.

Investors must carefully assess these risks, and then match their investment strategy to their risk tolerance and financial goals. The bottom line is that investors are responsible for assessing risks and matching investment strategies to their level of risk stake and financial goals.

How you can Invest in REITs according Money 6x REIT Holdings

You can invest in REITs through a variety of channels, such as:

- Direct Investment: Equity Investors can purchase REITs on the exchanges via brokers or online trading platforms. It allows you to choose the REIT that you prefer based on its industry.

- REIT Mutual Funds – Life company mutual fund based entirely on real estate trusts gives you the chance to diversify your portfolio and own real estate trusts. REIT Mutual Funds: Investing in REIT mutual funds offers investors exposure to many properties, and the risk is reduced compared to investing in individual REITs.

- Exchange-Traded Funds (ETFs). REIT ETFs work in a similar way to mutual funds, in that they diversify your holdings by bringing together a variety of REITs. ETFs, however, are listed in stock exchanges just like stocks, which provides liquidity and flexibility.

- Real estate crowdfunding platforms: These online platforms allow investors to pool their money and invest in specific real estate projects. These platforms offer access to more properties than traditional REITs.

You should also learn about the costs and fees associated with the different options. A financial planner can help you determine whether REIT investments fit into your overall investment strategy.

Also read about :What is Capital Injection MonieVest: Step by Step Guide

Diversifying Your Portfolio with REIT Holdings

REIT stocks, in addition to delivering diversification returns, can also be used to add variety into an investment portfolio by adding untraditional asset classes. Real estate also has the ability to reduce correlations with stocks and bonds, as well as a chance to reduce overall portfolio risks.

Consider the following when diversifying your portfolio through REITs:

- A portion of your portfolio should be allocated. Decide if you want to invest in REITs based on the amount of risk you are willing to take and what your goals are. When you seek advice, it is common to be told to add between 5 and 15 percent of your portfolio to real estate, including REITs.

- Consider Different Property Types. Adding REITs invested in different types of property can also help you achieve this goal. This would diversify your portfolio. It may be possible to mitigate the risks of certain property types or sectors.

- Assess Geographical Exposition: By investing in REITs that have holdings across different geographical regions (such as those with blended properties types or diversified property portfolios), you can reduce your risk, as the individual sectors will not be overly dependent upon one another. The overall risk can be reduced by not being too exposed to local market conditions, and participating in cycles of real estate and diverse economics which result in a broader market exposure.

- Monitor and Rebalance – Always monitor the performance of your REIT and adjust or relocate your portfolio as needed. The process of selling assets and incorporating new ones into the portfolio allows for the alignment of the portfolio to the goals and tolerance level.

- Diversify your portfolio with REIT Positions can be used to reduce risks and increase profits while gaining access to the property market.

Conclusion: Money 6x REIT Holdings

Investors who are looking to accumulate real estate assets but do not want to manage property issues can benefit from money 6x REIT investments.

Before investing, it is important to do thorough research and understand the finer points of this topic.

Investors must be able to assess the risks and returns of a REIT investment by understanding the diverse REIT holdings. These include both types of property and quality assessments and performance indicators. To maximize profits, it is important to keep track of the RIT investment’s performance and rebalance the portfolio periodically.

You can now work with REITs with confidence, whether you have a history of investing in real estate or are just getting started. You will get the best results by following the instructions above. This will help you make smart investment decisions and benefit from REITs.

For more information visit our home page.