What Is Form 4797: Sales of Business Property?

The Internal Revenue Service (IRS) distributes Form 4797, which is the tax form for sales of business property. This form is used to report the gains from the sale or trade of business property.

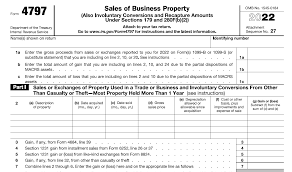

Entities must include the following information when completing Form 4797:

- Description of the property

- Purchase date

- Date of sale or transfer

- Cost of Purchase

- Gross sales price

- Add the depreciation to the sale price

KEY TAKEAWAYS

- The Internal Revenue Service (IRS) distributes Form 4797, a tax document.

- Form 4797 can be used to report the gains from the sale or trade of business properties, such as property that is used for rental income or property that has industrial, agricultural, or extractive resource uses.

- Filling out Form 4797 requires entities to provide the following: a description, date of purchase, date of sale or transfer, cost of acquisition, gross sales value, and depreciation.

Who Can File Form 4797?

On Form 4797, you can report business property which includes property purchased to generate rental income. On Form 4797, taxpayers can also report the home they used for a business. Form 4797 is used to report gains from the sale of geothermal, mineral, oil, gas, and other properties.

Gains on the sale of a property that was partially used for business or income production, while also being a primary residence, may qualify for exclusion from tax. It is usually the case that self-employed people and independent contractors generate their income at home.

Subtracting the cost basis, or purchase price, from the total of the sales price less any depreciation charges yields the net profit or loss from the transfer or sale of the business property.

How to file Form 4797

The Form 4797 is divided into four sections. The form 4797 has four parts. Capital assets held longer than a year and sold at a profit are recorded in the section Part III: Gain From Disposition of Property Under Sections 1245, 1250, 1252, and 1254. Capital assets that have been held longer than one year and are sold at a profit will be recorded in Part III: Gain from Disposition of Property under Sections 125 and 1250.

The Recapture Amounts under Sections 180 and 28F(b), (2): When Business Use is Reduced to 50% or less, are listed in Part IV.

A business such as a flow-through entity, like a partnership, or S Corporation, can sell a property, and partners and shareholders could experience a tax loss or gain when a Form 4797 is filed. form 4797 instructions is required for the disposition of capital assets that are not included in Schedule D

What is the difference between Schedule D and Form 497?

Schedule D is used to report gains on personal investments. Form 4797, however, is used for gains from real estate transactions that are primarily business-related.

Which form should you use?

In most cases, Form 4797 is sufficient to report gains from the sales of real estate. When deferring capital gain through investment in qualified funds, Form 8949 is required.

How Can I Avoid Capital Gains on Business Sales?

Capital gains tax cannot be avoided, but it can be deferred. You can defer capital gains tax by reinvesting the capital gain on a sale of a business in an opportunity zone. 10

Conclusion:

IRS Form 4797, Sales of Business Property (Reporting Financial Gains), is used to report any financial gains made by selling or exchanging business property. The form asks for many details, including the type of property, its purchase date, the depreciation, and the cost.

For More Information visit Our HomePage: