What Is a Perseroan Terbatas (PT)?

Perseroan Terbatas is a type of legal entity a foreign business, foreign government or foreign individual will need to use in order to generate revenue in Indonesia. A PT, also known as a limited liability foreign investment company, is a type of business entity that allows for foreign investors to carry out commercial activities in Indonesia.

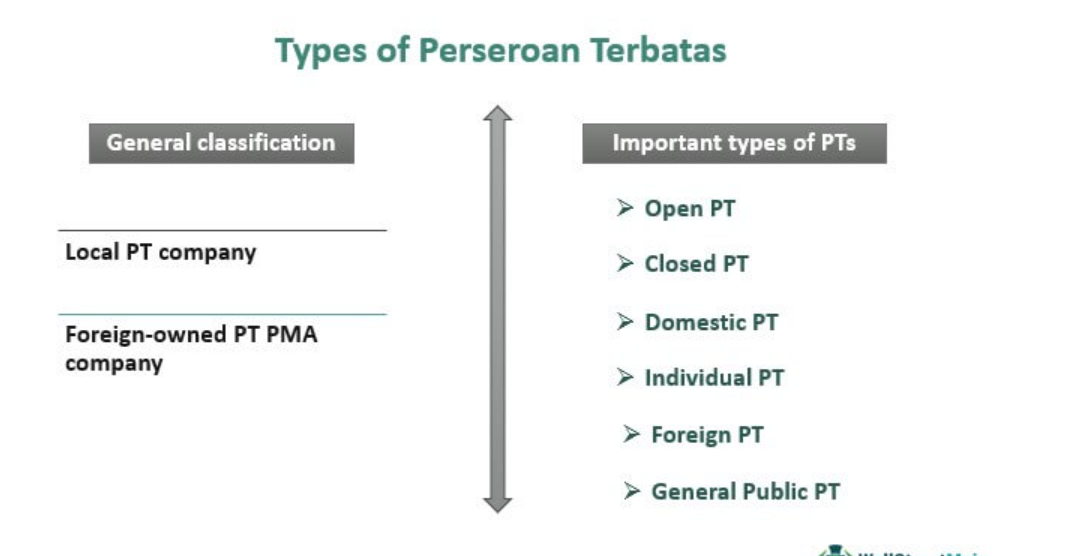

A PT is required for any Indonesian company receiving direct foreign investment. A PT can be classified as open, closed or domestic, foreign, private, or public.

Main Points

- Perseroan Terbatas is a legal entity that allows investors from abroad to operate a business in Indonesia.

- The structure of a Perseroan Terbatas is similar to a Limited Liability Company found in the United States. However, there are important differences when it comes to Indonesian government regulations which foreign investors have to follow.

- Some PTs offer shares for sale on stock exchanges. This allows individual investors to become part owners of the company.

- In Indonesia, there are many different types of PTs, including domestic, open, and closed PTs, as well as PTs for individuals, general public, and private companies.

Understanding a Perseroan Terbatas (PT)

Each country has its own legal entity type. A limited liability company is the American equivalent to a Perseroan terbatas.PTs are similar to corporations. Limited Liability Companies (LLCs). Shares can be offered to the public.If a PT declares bankruptcy, its shareholders are legally liable to pay the debts of that company.Investors are only responsible for their initial investment The Articles of Association A PT share ownership chart.

Indonesian law regulates the types businesses that are allowed to operate as a PT. The rules for PTs can vary depending on the region. License requirements will vary depending on the work that each business is involved in. Although the United States also has similar business entities to Indonesian PTs, the rules and guidelines that apply to a PT are governed by Indonesian law.

Many countries define business differently and have different stipulations. While a PT is similar to the limited liability company in the United States there are some fundamental differences attributed the governing laws.

Types of Perseroan Terbatas (PTs) in Indonesia

There are a few basic types of PTs.

Open PT

Open PTs are LLCs that offer shares for sale to the public. This type of LLC typically offers ownership shares that can be purchased by the majority of investors. Buying and selling stocks are relatively simple.

Closed PT

Closed PTs are LLCs that offer only private share, and limit the sale of these shares to certain individuals or groups. This restriction is common among family-owned companies.

Domestic PT

Domestic PTs are LLCs that offer their goods and services in Indonesia. These types of PTs are required to adhere to the rules governing business in Indonesia.

Individual PT

A single-person LLC is an LLC that has shares owned and issued by just one person. The individual PT is an LLC with shares owned and issued by only one person.

Foreign PT

A foreign PT is a LLC that has been incorporated and is subject to the laws of a different country. A PT established by an external company in Indonesia is subject to Indonesian laws and regulations.

General Public PT

General public PTs are LLCs that have a system of free shares. This type of company allows any entity to own shares. This structure is very similar to that of an open PT. The shares of these companies can be listed on the Stock Exchange

Requirements for Perseroan Terbatas (PTs)

The Indonesian Investment Coordinating Board is a Non-Ministerial Government Agency that serves as a middleman between the government and private companies. The BKPM implements policy and coordinates foreign direct investment according to the country’s regulations. The BKPM has a mandate to increase the quality of domestic and foreign investment in order to drive Indonesia’s economy and promote employment growth.

Here are the steps to establish a PT, and how long it might take you to complete them:

- Get a business license and a principal license in seven days

- The Deed of establishment (containing the Articles of Association) must be legalized before it can be filed at BKPM. This usually takes one to two working days.

- The Ministry of Law and Human Rights must receive the legalization of the PT PMA within 10 days.

- Three days is required to get a Domicile letter from the local district authority

- Three days may be required to obtain a tax identification number (NPWP), and a taxable entrepreneur registration (PKP) number from the local tax office.

- The Agency for Integrated Licensing Services (BPPT) issues a Certificate of Registration (TDP) to the company within 14 days.

- Manpower Reports and Company Welfare Reports from the Ministry of Manpower’s sub-department — every seven days

(FAQs) about Perseroan Terbatas (PT)

What is Perseroan Terbatas in Indonesia?

In English, Perseroan Terbatas is the legal entity used to establish a business in Indonesia. In Indonesia, it is the equivalent of a Limited Liability Company( LLC ).

What are the types of Perseroan Terbatas?

PTs are classified as Local PT companies and Foreign-owned PT PMA companies. Owners of Local PTs include Indonesian citizens. A Foreign-owned PT PMA allows 100% foreign ownership.

What are the requirements for a PT company?

To create a PT in Indonesia, there are many requirements that must be met. Capital requirements are among them. Capital requirements for a small business should be higher than IDR50,000,000 and lower than IDR500,000,000, whereas they are above IDR10Billion for a large PT. The Notary is also required to sign prescribed documents.