What is Bitcoin( BTC )

A decentralized digital asset is bitcoin. It is a brand-new asset class that goes together with more conventional assets like money, gold, and real estate.

A decentralized digital asset is bitcoin. Let’s dissect that.

Bitcoin includes several conventional assets, like gold and cash. It can be used, for instance, as a store of value or as money.

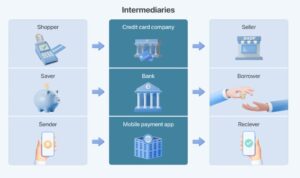

Bitcoin is unique in part because of its decentralized, “trustless” architecture. This implies that using Bitcoin eliminates the need for dependable intermediaries like banks. These third parties, who frequently go by the name of intermediaries, serve as go-betweens.

There is always a business—typically more than one—between your transactions in traditional finance.

There are often many more go-betweens than what appears to be one. Use an app for stock trading, for instance. Between you and a merchant, there may be as many as twelve middlemen who charge for their services!

Furthermore, physical currency and Bitcoin are comparable in that they can be exchanged directly, without the involvement of third parties, and without requiring authorization to open an account—a contrast to nearly all contemporary financial transactions, which are conducted over the internet.

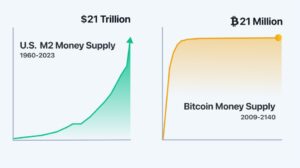

Intermediaries are not necessary when exchanging cash directly; nevertheless, the generation of cash depends entirely on a reliable third party, like a central bank. In contrast, new Bitcoin is created procedurally and is restricted to 21 million pieces. Later on, more on this.

Bitcoin price today

Bitcoin price usd

MARKET:

MARKET STATE BITCOIN:

About Bitcoin

The first cryptocurrency in history, Bitcoin is securely kept and traded online using a blockchain, a type of digital record. Bitcoins can be divided into smaller units called satoshis, with 0.00000001 bitcoin worth of value in each satoshi.

Resources

- Whitepaper

- Official website

How does Bitcoin work?

The blockchain, a piece of software that functions as a ledger and records every transaction ever made using Bitcoin, was the main innovation of the cryptocurrency. The Bitcoin blockchain is distributed and verified via a network of computers, unlike a bank’s ledger. This means that anybody can join the network and that it is not controlled by any one organization, nation, or third party. In order to find a new block that is added to the blockchain, users must solve computationally challenging puzzles. This is how fresh bitcoins are put into circulation.A fixed quantity of bitcoins are awarded to the people who solve the riddle the quickest. Lastly, using the public version of their key—that is, the version of their private key that can be freely shared in order to securely receive funds—anyone, anywhere with Internet access can finally send, receive, and keep Bitcoin.

What are the potential use cases for Bitcoin?

The fact that Bitcoin was among the first cryptocurrencies to hit the market is one of its benefits. It has succeeded in establishing a worldwide community and a new sector of the economy with millions of enthusiasts who produce and utilize Bitcoin and other cryptocurrencies on a daily basis. Because of its potential for long-term utility, Bitcoin is sometimes referred to as “digital gold.” In addition, it serves as a decentralized means of trade that grants ownership rights for both monetary units and tangible assets.

What is the history of Bitcoin?

Under the identity Satoshi Nakamoto, a person or group of people introduced Bitcoin in January 2009. Although the paper that introduced Bitcoin wasn’t the first to draw inspiration from the fields of computer science and cryptography for a digital currency (in fact, it made reference to earlier concepts), it was a particularly elegant way to solve the problem of building trust between various online entities where people may be geographically dispersed or hidden behind pseudonyms, as in the case of Bitcoin’s creator. Nakamoto mined the genesis block, the first block on the Bitcoin network, while the first recorded Bitcoin transaction was on May 22, 2010, when programmer Laszlo Hanyecz exchanged 10,000 Bitcoins for two pizzas. We now refer to this occasion as “Bitcoin Pizza Day.” Many people have patched problems and added new features to the cryptocurrency’s software over the years, making it better. Over 750 contributors are listed in the source code repository for Bitcoin. The fundamental aspect of Bitcoin’s appeal is that it is not governed by a single entity, and Satoshi’s name has never been disclosed (and probably never will be).

How can I buy Bitcoin?

To purchase, send, and receive Bitcoin, you can open an account with Coinbase or a growing number of other respectable financial technology firms. Traditional financial portfolios are becoming a more accessible way to access Bitcoin; in October 2021, for instance, the first ETF based on Bitcoin futures was approved. (Investors frequently use exchange-traded funds, or ETFs, to increase their exposure to assets like tech stocks, gold, and now Bitcoin.)

What is Bitcoin mining?

Bitcoin is frequently regarded as a “store of value,” much like gold. “Mining” produces new bitcoins (up to a maximum of 21 million coins). Thousands of computers compete with one another across the world to record and validate transactions on the network through a process called bitcoin mining. These sophisticated computers, sometimes referred to as “mining rigs,” solve the equations needed to confirm and log a fresh transaction. Early on, almost everyone who was interested could participate because a standard desktop PC had adequate power to do so. But these days, the computers needed are huge, specialized, and frequently owned by companies or huge groups of people pooling their resources. According to estimates from academics at Cambridge University, as of October 2021, American miners accounted for the largest share of all miners worldwide.

Regulating Bitcoin:

It has been challenging to regulate Bitcoin, as with any new technology. While attempting to regulate Bitcoin, the current administration treads carefully so as not to stifle a sector that is expanding and producing economic benefits.

According to Biden, he will work to stop Bitcoin from being used illegally while yet promoting its growth. The United States has placed a special emphasis on controlling cryptocurrencies and its illicit use abroad. This includes imposing sanctions on cryptocurrency exchanges and wallets, as well as retrieving payments made with bitcoin to criminals.

The regulatory landscape will evolve along with Bitcoin and the cryptocurrency industry, and several legislation and adjustments will occur over time.

FAQs

How Long Does It Take to Mine One Bitcoin?

The mining network needs ten minutes on average to validate a block and produce the reward. 6.25 BTC is the Bitcoin payout for each block. This means that mining one Bitcoin will take roughly 96 seconds.

Is Bitcoin a Good Investment?

The brief history of bitcoin investing is marked by extremely erratic price swings. Your financial profile, investing goals, risk tolerance, and portfolio will all determine if an investment is a good fit for you. Before making an investment in cryptocurrencies, you should always seek guidance from a financial expert to be sure it is appropriate for your situation.

How Does Bitcoin Make Money?

Miners on the Bitcoin network profit from the cryptocurrency by correctly validating blocks and receiving rewards. Bitcoins can be used to make purchases from businesses and stores that accept them, and they can be exchanged for fiat money through cryptocurrency exchanges. Speculators and investors can profit from the purchase and sale of bitcoins.

How Many Bitcoins Are Left?

There are 19.51 million Bitcoins in circulation. As of October 10, 2023, there will be roughly 1.4 million Bitcoins left to be mined.

The Bottom Line

The original cryptocurrency, known as Bitcoin, is meant to be used as a means of payment in addition to official cash. Since its launch in 2009, Bitcoin’s use has grown and its popularity has increased, giving rise to a large number of competing cryptocurrencies.

While creating Bitcoin is a complicated process, investing in it is simpler. On cryptocurrency exchanges, investors and speculators can purchase and sell Bitcoin. Like any investment, investors should carefully assess if Bitcoin is the correct investment for them, especially since it is a relatively new and volatile asset.

The remarks, viewpoints, and analyses presented on Investopedia are solely meant to be informative. For further information, see our liability disclaimer and warranty. The author does not currently possess any cryptocurrency as of the date this post was written.

FOR MORE INFORMATION VISIT OUR HOMEPAGE: