Bitcoin halving, which will see the new bitcoins created every 10 minutes cut in half, is expected to happen on either Friday or Saturday. Analysts are split on whether this event will be followed by an increase in bitcoin’s price.

Bitcoin reached record highs of $73,000 in the last month. This was the first time that record highs were achieved before a halving. However, the price has fallen over the past few weeks. Bitcoin was trading at $63,500 on Thursday morning after falling below $60,000 the previous day.

What Happens at the Halving?

The incentive for bitcoin mining and the rate of issuance of bitcoins will be reduced by half after the halving. Satoshi Nakamoto, the creator of Bitcoin, “set in stone”, this rule.

Bitcoin mining is a process that verifies all Bitcoin transactions and creates new bitcoins. The first miners to validate a block of transaction data are rewarded.

The reward is composed of a block subsidy as well as transaction fees. The block subsidy, which is a newly created bitcoin entering into existence for the very first time, has historically accounted for most of the value in the block reward.

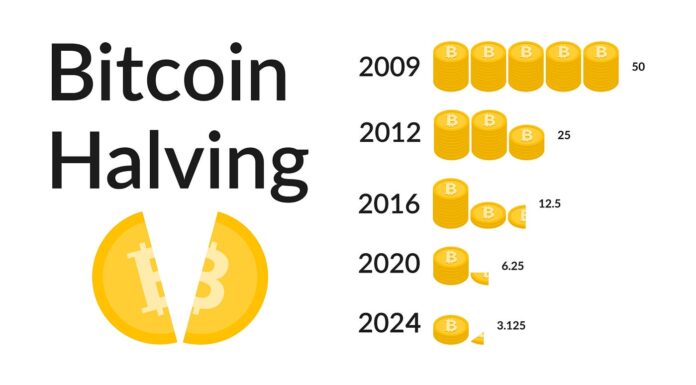

The block reward, which was 50 bitcoins when the network first launched in January 2009 has been halved every 210,000 blocks or approximately every four years on a predetermined timetable. The block reward is set to drop from 6.25 bitcoins, which it currently is, to 3.125 Bitcoins after the upcoming halving.

Block times may vary in the short-term depending on the computing power directed at the network. The mining difficulty is adjusted roughly every two-weeks to bring block times back into the target ten-minute window.

What does the price halving mean for Bitcoin?

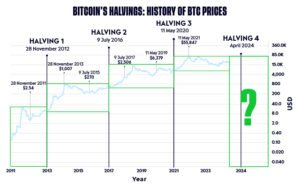

The market is aware of the schedule for the bitcoin halving’s, but the drop of 50% in the creation of bitcoins will alter the supply and demand dynamics of the crypto asset. Each of the three previous bitcoin halving has led to a new high for the bitcoin price.

Analysts claim that the bitcoin halving this time is different and may not lead to a rally.

This four-year cycle, the largest cryptocurrency in terms of market capitalization reached a new high before the first halving ever took place. The rally was largely due to the demand for bitcoin from exchange-traded funds that hold spot bitcoin. Many analysts believe a mismatch between demand and supply due to the ETFs’ increased demand and the limited supply following the halving could drive bitcoin prices higher.

The analysts at Deutsche Bank claim that the halving has been “partially price in” and they don’t “expect the prices to rise significantly after the halving”.

Analysts are concerned that riskier assets, such as cryptocurrency, will become less appealing as interest rates continue to rise.

Goldman Sachs analysts wrote a note in a last week’s Coindesk. “Whether BTC halves next week will be a buy the rumor and sell the news event is arguably less of an impact on BTC’s medium-term outlook. BTC price will continue to be determined by said supply-demand dynamics, continued demand for BTC-ETFs, combined with the self reflexive nature crypto markets, is the primary determiner for spot price movement.”

Bitcoin is definitely experiencing some anxiety before the halving. Since April 8, the price of Bitcoin has fallen more than ever before. This is not the first instance of this happening. The bitcoin price dropped prior to the halving in 2016, before reaching a new high the following year.

Bitcoin Halving price and Stocks

The bitcoin halving could affect three different types of stocks: bitcoin miners, bitcoin holding companies, and bitcoin trading platforms.

Bitcoin Mining Stocks

Bitcoin miners’ revenues are threatened by the reduction in the mining incentive.

The shares of bitcoin miners like Marathon Digital (MARA), Riot Platforms(RIOT), Hut8(HUT), Cipher Mining(CIFR)and TerraWulf (“WULF”) each lost around one-fifth their value in the eight days that followed the beginning of the bitcoin slump on April 8th, though they have gained some ground recently.

Analysts suggest that an increase in bitcoin’s price may offset the impact of reduced bitcoin rewards. However, miners will need to find ways to compensate for this gap on a long-term basis before the next halving.

Bitcoin Investors and Trading Platforms

MicroStrategy’s portfolio held over 214,246 Bitcoins as of March 18. This large position could have an effect on the stock price, if bitcoin prices continue to fall. MicroStrategy’s shares have lost a quarter of value this month.

Trading platforms like Coinbase and Robinhood could be affected by any volatility surrounding the halving. However, even if the trading volume picks up this week the analysts at Needham stated that the impact of halving could be overshadowed due to bigger bitcoin volumes events for the two platforms, Barron’s.

For more related information visit our home page.