Main Point:

- The Magnificent seven stocks – Nvidia, Meta (Amazon, Microsoft, Alphabet), Apple, Alphabet and Tesla – each gained at least 49% by 2023, and this boosted the market.

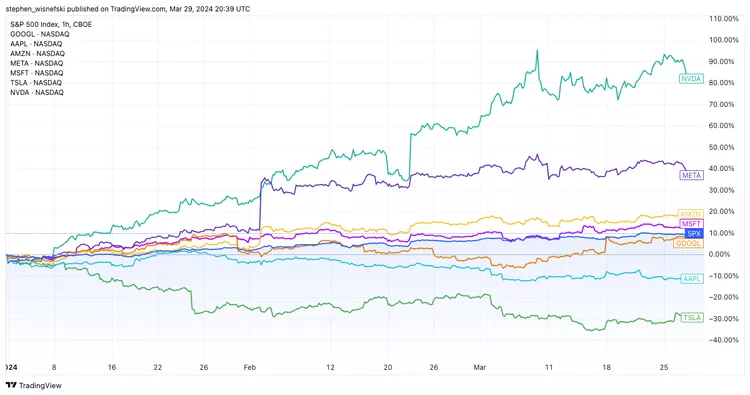

- Tesla has been the largest decliner on the S&P 500 so far this year.

- Investors need to be more selective and do their research. Last year, a bet made on the Mag 7 was a good strategy.

Magnificent 7 – a grouping of prominent technology companies – may be coming to an end.

The shares of these seven companies — Nvidia (NVDA), Meta, Amazon (AMZN), Microsoft, Alphabet (GOOG), (GOOGL), Apple and Tesla — rose 112% in average by 2023. Investors navigated high interest rates, fears of recession and poured money into companies which seemed to be poised to profit from artificial Intelligence.

The AI narrative is still in place, but there are more differences between the seven stocks. Apple and Tesla are the only stocks that have declined this year, with Nvidia and Meta posting huge gains.

The Mag 7 averaged a 17% increase in the first quarter compared to the S&P’s 10% increase. However, the performance ranged from Nvidia, with an 82% rise, to Tesla, which saw a near 30% drop. Four stocks have so far outperformed the S&P 500 index.

TradingView

It is no longer a good idea to assume that a group of investors will sustain the market uniformly. Analysts say that it is time for investors do their homework, and examine the fundamentals of companies they choose to invest in.

Dan Niles is the founder and portfolio manager of Satori Fund. He said that last year, any investor could have made money by betting on one of the seven hot stocks. This year, the best stocks are those that saw their numbers rise after they reported.

A Closer Look

Advisors and experts suggest that, with some stocks not performing as well in 2024 (as they did last year), it is better to look closely at the stock being purchased rather than blindly relying on the seven stocks to maintain the market’s upward trend.

Michael O’Rourke chief market strategist of Jones Trading said in an earlier interview that the Magnificent 7’s diverging outlooks have become apparent since they reported their quarterly earnings. Nvidia Meta, Amazon Alphabet, Microsoft and Amazon all reported strong results, while Apple Tesla fell short of expectations.

O’Rourke stated that the fundamental performance of every company was “dramatically different,” which made it difficult to classify each group as a single entity.

Niles cited Apple as an example of the market’s previous disregard for fundamentals. Apple cut its estimates for each quarter of last year and yet shares grew by more than 50%. Apple’s first-quarter results fell by 11%.

Tesla, whose stock price has doubled in the past year, has had a particularly difficult stretch, as the consumer demand for electric vehicles has declined, forcing it to reduce prices to encourage sales both in the U.S.A. and elsewhere, which has reduced its profit margins. While the EV market continues to grow, especially in China, there is increasing competition.

O’Rourke stated that “the EV space is under pressure since more than a month now.” This is manifesting in Tesla’s share price and business.

Fantastic Four or Super Six:

LPL Financial calls the six companies that were formerly Tesla the Super Six, while Niles refers to the four winners as the Fantastic Four.

The Roundhill Magnificent 7 ETF ( MAGS), which has been attracting increasing inflows, rose 17% during the first quarter.

Dave Mazza said that the ETF has assets of $175 million and offers exposure to seven stocks regardless of their performance, in an interview.

Mazza explained that the market is still centered around these seven names for the moment, and this is why all of them are in the portfolio.

Mazza explained that until there is a replacement name that can be definitively identified, we will still be exposed to the seven companies that are currently grouped together. If the market decided that a new security is magnificent and one of these companies no longer belongs, we would consider reevaluating.

For More Information visit Our Homepage: